If you’re buying or selling a home in Irvine (or anywhere in Orange County), you’ll hear the word “title” a lot during escrow. Title insurance in real estate is a key part of protecting a buyer’s ownership rights and helping confirm the property can legally transfer from seller to buyer.

What is a title insurance policy? In simple terms, it’s an insurance policy that helps protect a buyer (and often a lender) from certain ownership-related issues tied to the home’s recorded history, such as liens, recording errors, and claims that could surface after closing. Title insurance in real estate is very different from homeowner’s insurance because it focuses on past recorded issues, not future damage.

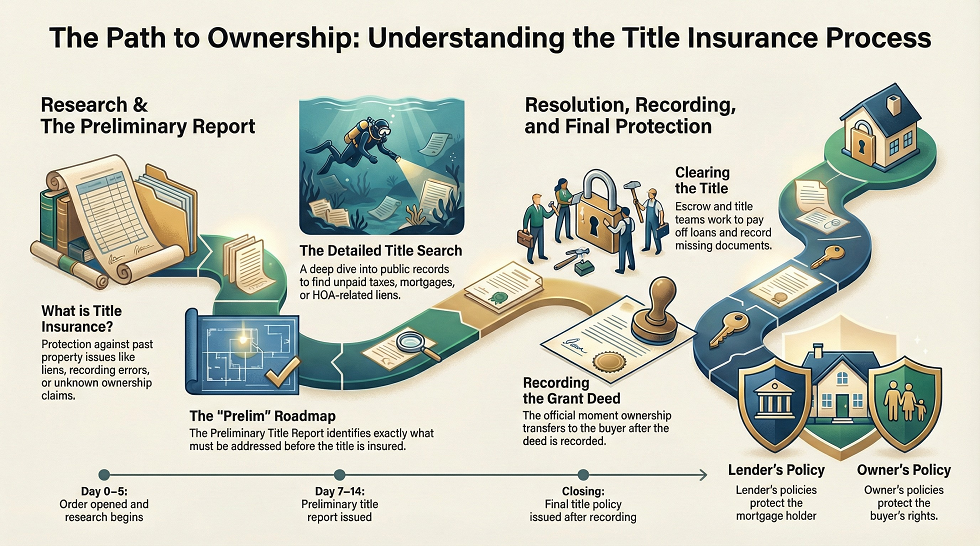

Below is a simple breakdown of what happens behind the scenes when a title policy is issued, and how it fits into the escrow process.

Want the full step-by-step buyer timeline too? Here’s my guide to escrow, inspections, and appraisals in Irvine.

What Is a Title Policy?

What is a title insurance policy? A title insurance policy helps protect against certain problems tied to the property’s past, such as:

- A lien that wasn’t properly cleared

- A recording error

- A missing signature in a past transfer

- An unknown heir claiming ownership

- A boundary or legal description mistake

In short, title insurance is designed to reduce the risk of ownership complications that could otherwise become expensive and time-consuming.

Who Issues the Title Policy?

A title policy is issued by a title company, and it’s prepared during escrow while your transaction is moving forward.

In Irvine, title and escrow often work closely together to confirm the property can transfer cleanly and correctly. Two local companies you may hear about are:

- Equity Title Company

- West Coast Escrow

The Step-by-Step Process of Issuing a Title Policy

Stage 1: The Title Order Is Opened

Once escrow is opened, the title order is placed. This begins the process of reviewing public records connected to the property.

The title company researches items such as:

- Current owner(s) of record

- Property legal description

- Loans and liens recorded against the home

- Easements (utility access, shared driveway access, etc.)

- Taxes and assessments

- Past transfers and recorded documents affecting ownership

Stage 2: The Title Search Begins

The title company performs a detailed search of public records to identify anything that could delay or prevent the property from transferring properly.

They are looking for items like:

- A mortgage that was never properly released

- Judgment liens

- Unpaid property taxes

- Ownership discrepancies (including name misspellings)

- HOA-related liens or unpaid dues

- Easements or restrictions that impact use of the property

Even in a normal escrow, this step is essential because it verifies the legal status of the home.

Stage 3: A Preliminary Title Report Is Issued (The “Prelim”)

After the research is complete, the title company issues a Preliminary Title Report, often called the prelim.

This is one of the most important documents in escrow because it shows what the title company found in public record and what must be addressed before closing.

The prelim typically includes:

- The current owner(s) of record

- How title is currently held (vesting)

- The legal description of the property

- Existing liens or recorded loans

- Easements and CC&Rs (if applicable)

- Property tax information

Important note: A prelim is not the final title policy. It’s essentially the title company’s roadmap for what must be cleared or confirmed before the title can be insured.

Irvine Title + Escrow Notes (Especially in HOA Communities)

In Irvine, title and escrow can involve additional steps because many homes are located in planned communities with HOA requirements and recorded restrictions.

This is especially common in neighborhoods like Woodbridge, where escrow may involve:

- HOA documentation and transfer paperwork

- HOA transfer fees and move-in requirements

- CC&Rs that affect the property

- Easements and recorded access areas tied to community planning

This doesn’t mean anything is “wrong.” It just means there can be more moving parts than in a non-HOA neighborhood.

Visual Timeline: Where Title Fits Into Escrow

Here’s a general timeline showing how the title process often flows:

| Escrow Day | What Happens |

|---|---|

| 0–5 | Title order opened and preliminary research begins |

| 3–10 | Title search completed |

| 7–14 | Preliminary title report issued |

| 10–25 | Items cleared or confirmed (if needed) |

| Closing | Final title policy issued after recording |

Every escrow is different, but this gives buyers and sellers a realistic overview.

Stage 4: Title Clears and Requirements Are Addressed

Once the prelim is issued, escrow and title work together to clear any items required before closing.

This may include:

- Paying off an existing loan

- Recording missing documents

- Correcting vesting or ownership details

- Clearing liens or judgments

- Confirming HOA requirements are complete

Some items are quick to resolve, while others can take longer depending on the situation.

Stage 5: The Grant Deed Is Prepared

A Grant Deed is the legal document that transfers ownership from the seller to the buyer.

The title and escrow teams prepare the deed, and it is signed prior to closing.

It includes:

- Seller name(s)

- Buyer name(s)

- How the buyer will take title (vesting)

- The legal description of the property

Vesting matters because it affects legal ownership and can also impact estate planning decisions, so it’s important to confirm this early.

Stage 6: Funding + Recording

Near the finish line, two key steps happen:

- Funding: The buyer’s lender sends loan funds to escrow (if applicable), and the buyer deposits any remaining required funds. Unlike in some other counties, in Orange County, we generally fund and record on the same day!

- Recording: The deed is recorded with the county, making the transfer official.

Recording is the moment the home legally changes ownership.

Stage 7: The Final Title Policy Is Issued

After recording, the title company issues the final title policy.

There are typically two types:

The lender’s policy protects the lender, while the owner’s policy helps protect the buyer’s ownership rights.

1) Lender’s Title Policy

- Required if the buyer is getting a mortgage

- Protects the lender’s interest

2) Owner’s Title Policy

- Optional, but highly recommended

- Protects the buyer’s ownership rights

Most buyers choose an owner’s policy because it’s a one-time cost and can provide long-term protection.

What Can Delay a Title Policy From Being Issued?

Many escrows close smoothly, but over the years I’ve seen occasional delays in issuing a title policy due to one of the following reasons:

- Escrow does not have the proper demands for loans/liens being paid

- Last minute statement of information submitted where a lien/judgment was found

- Documents containing incorrect notary acknowledgements that require new ones produced

- Unable to locate a good signature comparison and requires an ID for verification

- Lender delays funding

- Solar documentation is delayed

Most of these issues can be resolved, but they can impact timelines when they show up late in escrow. Catching potential red flags early is one of the best ways to keep a closing on track, especially in a busy market like Irvine.

Final Thoughts

Issuing a title policy involves far more than “just paperwork.” It’s a structured process of researching public records, confirming legal ownership, clearing required items, and completing recording so the home can transfer smoothly.

If you’re buying or selling in Irvine or Orange County, understanding how title fits into escrow can help you avoid surprises and feel more confident throughout the process.

People Also Ask (Title Insurance + Escrow)

What does a title company do during escrow?

A title company researches public records to confirm the seller can legally transfer ownership, identifies liens or restrictions, and issues title insurance after the home records.

What is a preliminary title report and why is it important?

A preliminary title report (the “prelim”) shows ownership, liens, easements, and other recorded items that may need to be cleared before closing.

Is owner’s title insurance worth it?

Yes, many buyers choose owner’s title insurance because it helps protect their ownership rights from certain hidden title issues tied to the property’s past.

What can delay title from clearing in escrow?

Common delays include unpaid liens, vesting errors, missing recorded documents, trust/probate requirements, HOA paperwork delays in planned communities, and lender funding delays.

Does having an HOA affect the title process in Irvine?

Sometimes. In Irvine HOA neighborhoods like Woodbridge, there may be extra documents, transfer fees, and CC&Rs that must be reviewed and processed during escrow.

Search Homes for Sale in Irvine

Search homes for sale in Irvine here.

About the Author

Debbie Sagorin, Irvine Realtor, Coldwell Banker Realty

CalRE #01411020

With 21+ years specializing in Irvine residential sales, including Woodbridge HOA communities, I’ve helped hundreds of buyers and sellers successfully close escrow and navigate title and HOA details.

I’m based in Irvine and work with buyers and sellers throughout Orange County, with a strong focus on Woodbridge and other Irvine communities.

This article is for general informational purposes only and is not legal advice. Your escrow officer, lender, and title company can provide guidance based on your specific property and transaction.